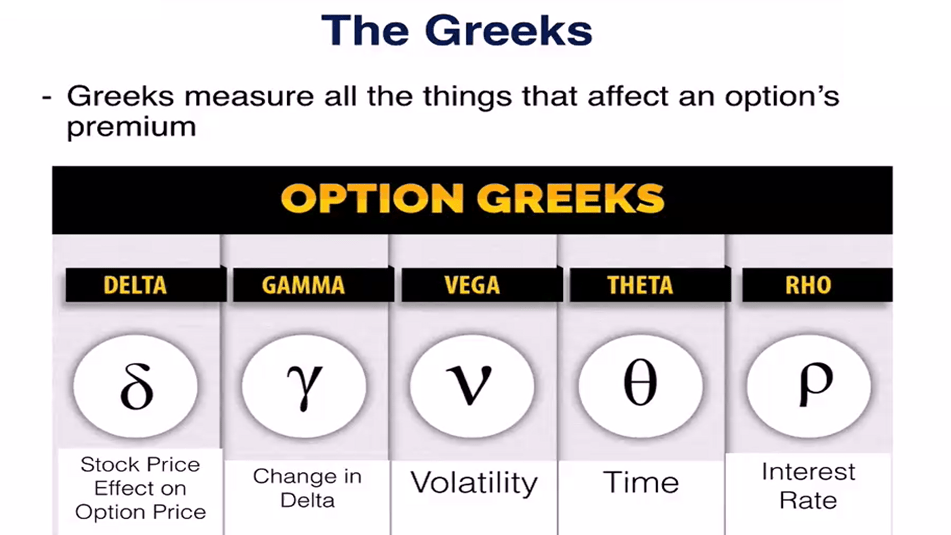

Understanding Option Greeks:

Option Greeks are essential tools that help traders understand the risk and potential rewards of options trading. Each Greek measures a different factor that can affect the price of an option, offering insight into how changes in market conditions, like time, volatility, or the price of the underlying asset, will impact the option’s value. Let’s break down the primary Greeks:

Who used option: Option used by Investor and Traders

For Investors

- Use option to hedge an investment portfolio (buy option)

- Used option to generate additional income for an investor (Dividends + Sell Premium)

- Use option to by stock at a discount or free

For Traders

- Option require less capital

- Magnify return and minimum risk

- Generate income from any market condition (Bullish, Bearish, Sideway)

Types of options

- Call Option= A contract that’s give the buyer the right to buy shares of a stock at a specific price on an expiration date

- Call Option

–Buy Call

–Sell Call

- Put Option= A put option is a contract that’s gives the buyer the right to sell shares at a strike price on an expiration date

- Put Option

–Buy Put

–Sell Put

Option Strike Price ATM, OTM, ITM

- At the money (ATM) is a situation where an option’s strike price is identical to the current market price of the underlying security

- In the money” (ITM) is an expression that refers to an option that possesses intrinsic value

- Out of the money” (OTM) is an expression used to describe an option contract that only contains extrinsic value

Option Price(Premium)

- Option Price= Intrinsic Value + Extrinsic Value

Intrinsic Value Call / Put Option

- Intrinsic Value Call Option = Stock Price – Strike Price

- Intrinsic Value Put Option = Strike Price – Stock Price

1. Time Value (Theta): The rate of decay of an option

- Time value decreases exponentially as time passes (Decreasing Extrinsic Value)

- Further the expiration date , more time value, the higher premium

- At expiration, Option Price = Intrinsic Value (Extrinsic Value = 0)

- Weekly option expire last Thursday of the week, and monthly option expire last Thursday of the month

2. Volatility & Vega

- Volatility makes up a large part of extrinsic value

- The higher volatility of a stock, the more expensive the option

- Volatility tends to increase during major news event

- Buy option when volatility is low

- Sell option when volatility is high

- Vega measures option premium change due to 1% move in IV

- Example: An option has a value of 100; Vega is showing 10. If IV move form 20% to 21%, the option value will increase to 110

- The further from expiration, the higher the vega

- Long Option = Vega Positive, Short Option = Vega Negative

- Vega is higher for ATM and longer term option

Implied Volatility: IV Rank

Value for volatility derived from the market price of an option calculated according to an option pricing model (Black scholes model)

IV Rank is a description of where the current IV lies in comparison to its yearly high and low IV

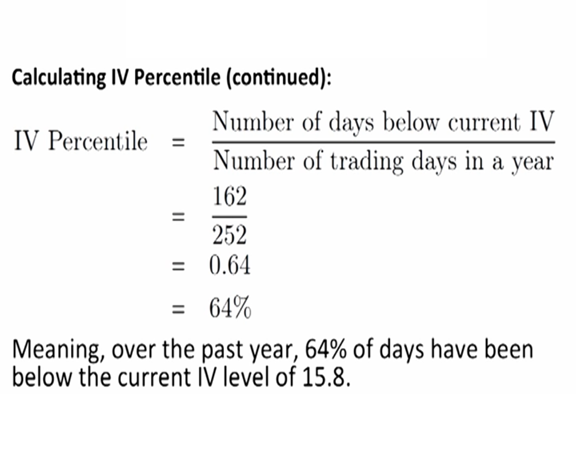

Implied Volatility: IV Percentile

IV Percentile tells the percentage of the days over the past year, that were below the current IV

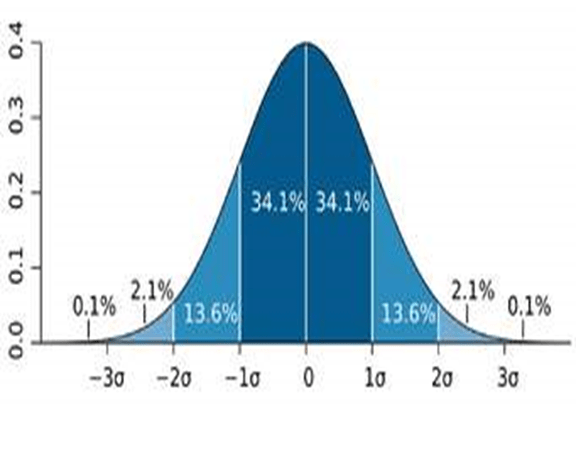

Standard Deviation: Standard Deviation shows us the probability of a price movement in a specific time period to the certain level

For example:

Stock price = 1000

IV = 40%

- Sell option when IV above 50%

- Buy option when IV below 40%

Difference Between IV, IVR, IVP and Vix

- IV: Value for volatility derived from the market price of an option calculated according to an option pricing model (Black scholes model)

- IVR: IV Rank is a description of where the current IV lies in comparison to its yearly high and low IV

- IVP: IV Percentile tells the percentage of the days over the past year, that were below the current IV

- India VIX: It is the volatility index that measures the market’s expectation of volatility over the near term. In other words, it explains the volatility that the traders expect over the next 30 days in the Nifty50 Index.

- The Black scholes Model uses five important variables like strike price, the market price of the stock, time to expiry, the risk-free rate, and volatility

3. Delta

- Delta is the change in the option price relative to the change in the underlying stock price

- Delta of 0.80 (80 Delta) means option price increase Rs.0.80 for every Rs.1 increase in the stock price.

- Delta is also the probability that the option will be ITM at expiration

- Delta also used determine the adjustment point

Delta for call is 0 to 1

ITM call is 0.5 to 1 Delta

ATM call is 0.50 Delta

OTM call < 0.50 Delta

Delta for the puts is 0 to -1

ITM put is -0.5 to 1 Delta

ATM put is -0.5 Delta

OTM put > -0.5 Delta

4. Gamma

- Measures change in delta due to Rs.1 move in underlying stock price

- Also known as Delta of Delta

- Gamma is highest when option is ATM

- Gamma increase the closer to expiration

Open Interest:

- A total number of option contracts that are currently open and active ie. Contact that have been traded but have not yet been closed, exercised or assigned.

- Open interest number does not change throughout the day, but adjust itself before the next day once the trades are total

read more: